Call to Order (General Comments)

Mayor Gutierrez called the Special meeting to order at 8:07 a.m. Mayor Gutierrez mentioned for those who have signed up to speak, that he would address them after the presentations have been made.

Welcome/Overview

- Discussion and direction regarding mid-budget preparations, including but not limited to City Policies and Capital Improvement Program. (M. Browne)

City Manager Dr. Browne provided the following regarding the retreat overview.

• COVID-19 Overview

Fire Chief Kade Long, City Manager Dr. Browne and Finance Director James Walters provided updates regarding current numbers, current and anticipated fiscal impact regarding anticipated savings, impact on sales tax, and lost revenues as well as addressed questions from Council.

• Current FY 19/20 Budget

Engineer John Nowak and Public Works Director Suzanne Williams provided the following updates: addressing questions from Council:

• CIP Update - Use of excess reserves were invested in core infrastructure areas: Streets - Completed projects in FY19/20, street projects ongoing funded in FY19/20, SPAM Projects, Sidewalks - completed in FY 19/20, ongoing

projects funded in FY19/20, Drainage - completed projects in FY19/20 and ongoing projects funded in FY19/20.

Mayor Gutierrez recognized Mr. Cedric Edwards, 1016 Keanna Place who addressed Council regarding the need for more budgeted dollars for streets, he mentioned that he and others in neighborhood were not happy with the chip seal placed on the roads in The Estates of Wilson's Preserve.

Assistant City Manager Charles Kelm provided a Facilities update for FY19/20 addressing questions from Council.

Parks, Recreation and Community Services Director Lauren Shrum provided a Parks update for FY19/20 addressing questions from Council.

CIP Wrap-up: City Manager Dr. Browne provided a wrap-up stating we have completed a lot of projects and have many ongoing, but is it sustainable in personnel and resources? Dr. Browne addressed questions from Council.

• FY 20/21 Budget Key Messages

City Manager Dr. Browne and Finance Director James Walters provided the FY 20/21 Budget Key Message

- Budget built in with Scenario 1 in mind: Direction from Council at the pre-budget retreat - more emphasis on "business as usual."

Change in Revenue/Expense Projections - More aggressive/more risk - expenses - increase vacancy rate for personnel, revenues - increase sales tax percentage, increase property tax percentage. Estimated additional funding of $440.000.

• FY 20/21 Budget Highlights & Discussion

Various Staff members provided information on the following addressing questions from Council.

• Comprehensive Land Use Plan/Unified Development Code Update (Brian James presented)

Proposed to include following components:

Updates to Future Land Use Plan, Parks Master Plan, and any sub-elements we desire to include (housing, education, etc.) Will also look at implications to Master Thoroughfare Plan and Water and Sewer Master Plan.

• CIP Funding: Streets (John Nowak presented). Parks/Trails (Lauren Shrum presented) Drainage & Sidewalks (Charles Kelm/Suzanne Williams presented)

Allocated additional funds in General Fund for following areas:

Streets - $200,000

So how much do we have for streets next year?

Amount currently have in General Fund (recurring) -$210,000

Estimated remaining 19/20 Reserves - $320,000

Some bond funds from NTE left over - ?

Amount adding (one-time) - $200,000

Total: Estimated ~$700,000+?

Staff reviewed how we will spend the estimated $700,000

PCI Study $100,000

Contribution to FM 3009/FM 78 crossing study (with TxDot) - $200,000

Lindbergh (Main to Exchange) reconstruction and storm drain $720,000 - $1,000,000

Will prioritize these remaining 2020 CIP Projects in early FY 2020-21 when funding amounts finalized

Parks/Trails - $150,000

CIP Total General Fund Amount

Amount currently have (recurring) - $235,000

Amount adding (one-time) - $150,000

Total:$385,000

Staff reviewed how we will spend the $385,000

Thulemeyer Park additional parking $100,000

Ashley Park Pavillion $35,000

Ashley Park Playscape $65,000

Pickrell Park Improvements $35,000

North Trail section $150,000

Drainage - $100,000

CIP Total Funding Amount

Amount currently have (recurring) - $83,000

Amount adding (one-time) - $100,000

Total: $183,000

Staff reviewed how we will spend the $183,000

Amazon Channel - Design and Construction estimate $300,000

Remainder to be paid from Drainage Reserves

Sidewalks - $50,000

Sidewalks (part of PW Streets budget)

CIP Total General Fund Amount

Amount currently have (recurring) - $75,000

Amount adding (one-time) - $50,000

Total: $125,000

Staff reviewed how we will spend the $125,000

Projects: Curtis Avenue (Beacon to FM 1518)

Construction estimate $50,000

Finishes sidewalk from Clemens to 1518

Aero Ave. (Schertz Pkwy to 1518)

Construction estimate $150,000

• Facilities Update (Charles Kelm presented)

Fleet (Building 27) renovation (Design/Build)

$1.65M – Estimated Completion September 2021

Bldg 1 Court/Inspections/Billing Counter

$110K – Scope Development October 2020

Community Center Interior refinish

$20K – Scope Development October 2020

Civic Center Floor repair and replacement

$35K – Scope Development November 2020

Building 10 renovation (Parks)

$140K – Scope Development January 2021

Staff reviewed the Facilities CIP (Expanded Program-Funded)

• Class & Comp Implementation/employment cost index (ECI) (James Walters presented)

Fund at 97% of median over 5 years

Employment Cost Index (ECI)

1% initial (FY 20/21) - effective Oct. 1

0.25% following 4 years

End up at 2%

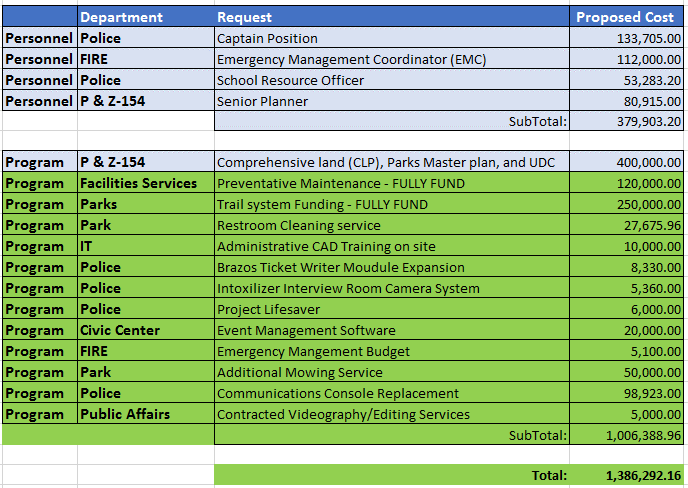

Funding personnel recommended by Staffing Study. (James Walters presented)

Update on 9 positions:

Patrol Officer – recruiting

Fleet Manager – hired

Engineer – offer in progress

Street Crew (3) – hired all 3

Park Maintenance Tech – interviewing, offer coming

Kennel (2) – one filled; second position interviewing phase

Evaluated requested positions based on study

Proposing 4 new positions:

Police – Captain

Police – School Resource Officer

Fire – Emergency Management Coordinator

Planning – Senior Planner

Mayor Gutierrez recessed the meeting at 11:30 a.m. for lunch break.

Mayor Gutierrez reconvened the meeting at 12:43 p.m.

City Manager Dr. Mark Browne and Finance Director James Walters provided Council with information on the General Fund Proposed Budget $37,214,581.

Increase of $972,075 or 2.7%, from FY 2019-20 adopted budget, not including infrastructure funding.

Non Personnel Budgets decrease 4.5% due to fewer capital purchases and lower tax abatement payments.

Personnel Budgets increase 6.9% to act on the Class & Comp Study, Merit, insurance, ECI, and add 4 positions.

General Fund: Proposed budget assumes a 26% fund balance requirement. Choices made in the proposed budget will reduce the fund balance to 26% over th next 5 years.

Long Term Debt Model discussion:

For I&S Fund - purpose to avoid large tax increases in future

Design: Model is long term in nature, includes all current debt obligations, takes into account the growth of the tax base, ensures fund balance never falls below a certain level

At I&S rate of $0.1651: includes the following upcoming debt issuances:

FY20/21 - FM 1518 $9,400.000 - committed/voter-approved

Infrastructure $1,500.000 - not assigned to projects

After FY20/21 - includes the following upcoming debt issuances:

FY22/23 - $20 Million - Fire Station 4 - $10.1 million; Roads/drainage/parks/facilities equipment

FY24/25 - $21 Million - Public Safety Building - $15-21 million

FY26/27 - $15 Million - Infrastructure

Discussion regarding 2020 Property Values

Tax Rate discussion:

- No New Revenue: The tax rate which will generate the same revenue for the city from property on the previous year's tax roll. $0.5079

- Voter Approval Rate: The rate if exceeded triggers an automatic election on the tax rate. $0.5247

- Current: The rate currently adopted by the City. $0.5146

- Proposed Max: The maximum rate set at which the final adopted rate cannot exceed. $0.5146 this amount the proposed budget assumes this rate. - $0.01 is equal to $390,000 revenue or $24.45 on the average home.

- Target Tax Rate

M&O Current rate $0.3496, Proposed Maximum $0.3495 - For day to day operations

I&S Current rate $0.1650, Proposed Maximum $0.1651 - To pay the City's debt

Total: $0.5146 Current - Proposed $0.5146

At $0.5079 No New Revenue Rate

Existing Residents Average City Tax Bill

2019 Tax Bill = $1200 Avg Home Value $233,200

2020 Tax Bill = $1241 Avg Home Value $244,500

Increase = $ 41*

*This represents the increase of the tax bill on the average taxable home value, including new construction.

At Current Rate $0.5146

Existing Residents Average City Tax Bill

2019 Tax Bill = $1200 Avg Home Value $233,200

2020 Tax Bill = $1258 Avg home Value $244,500

Increase = $ 58* (increase of $17)**

*This represents the increase of the tax bill on the average taxable home value, including new construction

**This represents the increase of the tax bill on the average existing home

At $0.5247 Voter Approval Rate

Existing Residents Average City Tax Bill

2019 Tax Bill = $1200 Avg Home Value $233,200

2020 Tax Bill = $1282 Avg Home Value $244,500

Increase = $ 82* (increase of $41**)

*This represents the increase of the tax bill on the average taxable home value, including new construction

**This represents the increase of the tax bill on the average existing home

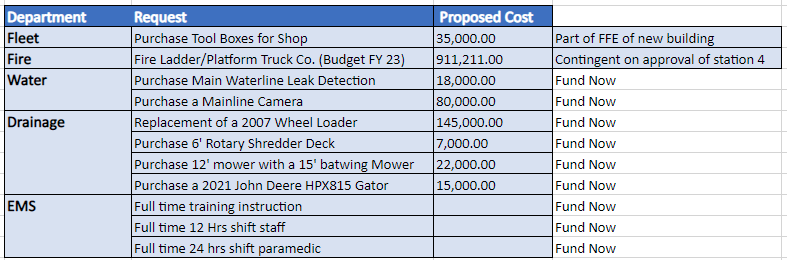

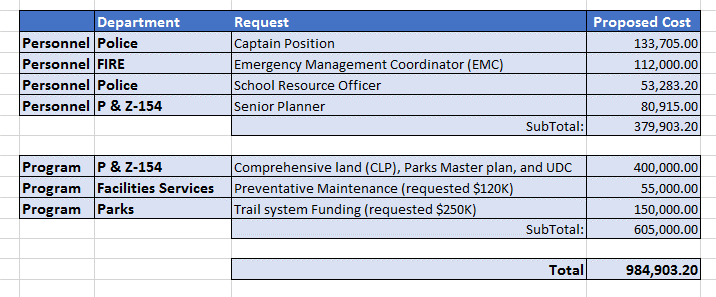

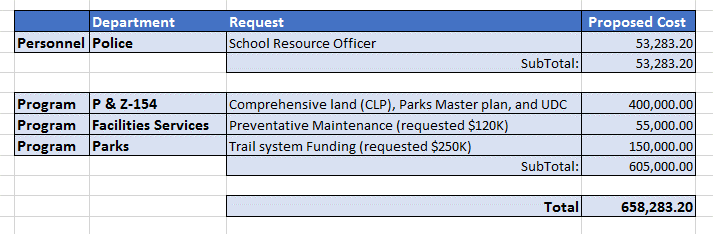

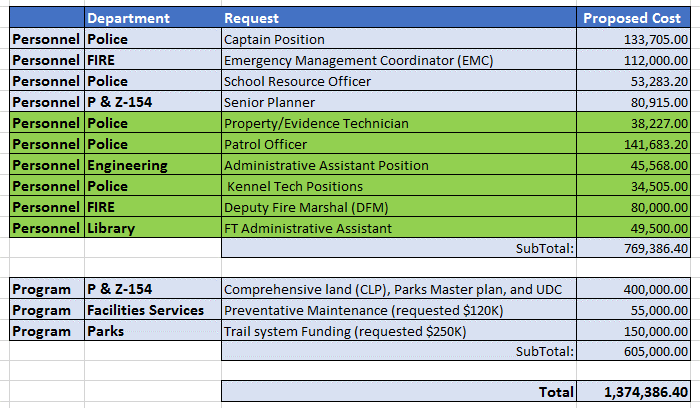

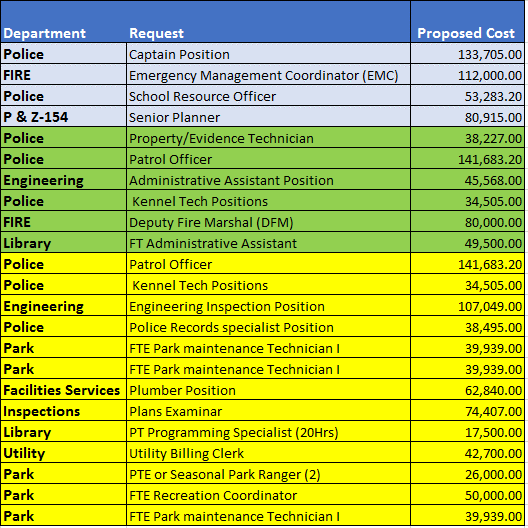

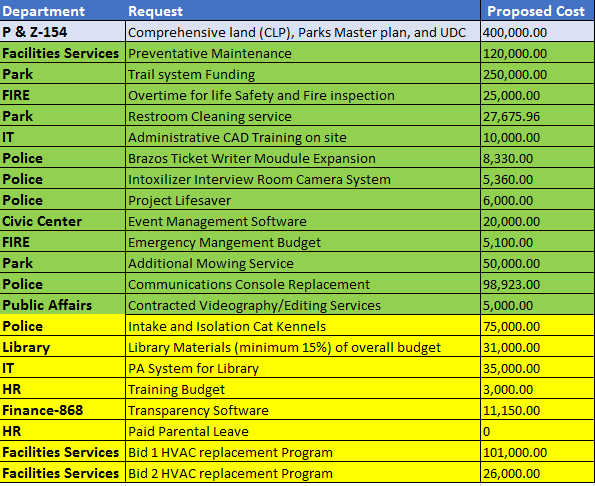

• Discussion and direction regarding the proposed expanded programs. (M. Browne)

Ms. Gonzales reviewed the programs/personnel now funded:

Ms. Gonzales provided proposed programs/personnel that would be funded at the Current rate of $0.5146:

Personnel funded at No New Revenue(Effective Rate) $0.5079 - Cut $260K recurring costs (Captain, EMS, Senior Planner Positions)

Discussion regarding cut line programs/personnel at voter approval rate $0.5247.Could fund additional 400K recurring personnel (in green)

Cut Line Discussion at Voter Approval Rate - $0.5247

OR Fund additional $400,000 in one-time programs (in green)

Cut Line Discussion - remaining unfunded requests (in yellow) - Personnel

Remaining Unfunded Requests (in yellow) - Programs

Cut Line Discussions continued for the remaining unfunded requests for personnel and programs.

Assistant City Manager Charles Kelm provided a PowerPoint on options and an overview of the police compression issues. Council concurred to continue to meet with the association to address their issues. HR and City Management to work with the employees, have ongoing conversations and come back with a report to Council in 60 days.